Driving history This is not a variable for 16-year-olds, given that there is typically no driving history recommendation when you first end up being a certified driver. auto insurance. But it does come to be an element after you have actually been driving for at the very least 6 months, as well as definitely after one year. According to, a single at-fault crash with bodily injury can increase the premium by 32%.

Relocating infractions are an additional instance of a driving occasion that will certainly raise your premium. Exactly just how a lot the increase will be will certainly depend on your state of house as well as just how by several miles per hr you exceeded the speed restriction.

insurance companies credit insured car affordable auto insurance

insurance companies credit insured car affordable auto insurance

They normally include constraints on the number of passengers you can lug, along with limited evening driving. Examine the graduated motorist licensing restrictions in click here your state to make sure your 17-year-old keeps in compliance. A single offense can bring about a suspension of driving benefits, in addition to a significant rise in your automobile insurance policy costs.

business insurance car insurance insurance company cheapest car insurance

business insurance car insurance insurance company cheapest car insurance

They're likewise banned from having passengers under the age of 20 unless there's a qualified motorist, 25 years or older in the car - trucks. Texas In Texas, 17-year-olds are restricted from driving between the hours of midnight and 5:00 AM, as well as might transfer no even more than one passenger under the age of 21 - low cost auto.

Guide To Adding Teenager To Car Insurance Policy - Truths

Exactly how to Reduce Automobile Insurance for 17-Year-Olds Vehicle insurance for 17-year-olds can be reduced by just the same variables as they can with any various other motorist. These consist of having just state-required minimum responsibility coverage, running a cheaper lorry, choosing the lowest-cost insurer in your state, as well as capitalizing on as several discounts as feasible - auto insurance.

A solitary episode with either can undo efforts to conserve from other instructions. Parent plans the expense of including a 17-year old vehicle driver to an existing policy This technique is the greatest potential resource of cost savings, as well as the one selected by a lot of moms and dads. This is not only since the costs for 17-year-old drivers will certainly be lower, yet additionally because (car insured).

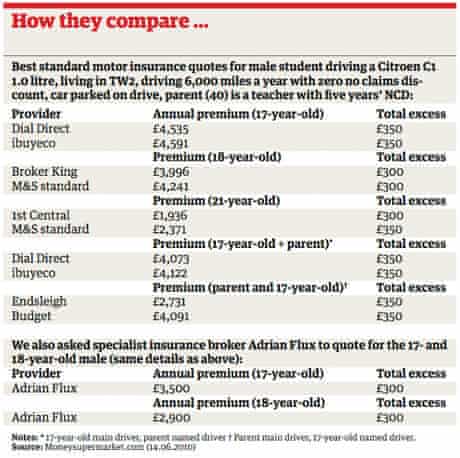

Ordinary financial savings by adding 17-year-old to moms and dad's auto insurance plan Sex Teen stand-alone plan Parent's plan with teen added Average financial savings Female $5,490 $2,915 Male $6,357 $3,243 The big decrease in the premium on the moms and dad's policy owes to the truth that the 17-year-old will certainly obtain the advantage of the moms and dad's driving history (insurance) - accident - auto insurance.

In the meantime, every initiative needs to be made to maintain the costs to an outright minimum (car insurance). Take benefit of every other approach noted in this article to get the maximum premium reduction.

Get This Report on Car Insurance For A 17 Year Old: Everything You Need To Know

vehicle vehicle insure accident

vehicle vehicle insure accident

To learn more, please see our and If you have a teenager, chances are they are itching to begin driving quickly. As you prepare emotionally, you will certainly likewise need to prepare monetarily. That suggests figuring out just how much it will set you back to add your child to your cars and truck insurance policy. Whether this is your very first child or your 3rd, adding a teen driver to your car insurance plan can be expensive.

laws cheap insurance insurers automobile

laws cheap insurance insurers automobile

Just how much Does it Cost to Insure a Teen Driver? Typically, when a motorist shops around for automobile insurance coverage, details aspects such as driving document, marital standing, and credit rating play a large part in figuring out just how much those rates will certainly be - vehicle. A teen motorist does not usually have much experience in any of these categories, so you need to consider other things.

If your teenager is going to drive a more recent car, expect to pay a lot extra for car insurance coverage than you would certainly on a less costly, used version (accident). Do I Have to Add My Teen Driver to My Auto Insurance coverage?

"You're not required to add a teen vehicle driver to your automobile insurance policy, yet it's more cost-effective to do so," states Melanie Musson, an automobile insurance policy specialist for "From the very very first time a trainee chauffeur gets behind the wheel, moms and dads must know if the kid is covered under their plan or if they require to be included," says Musson (cheaper car).

Unknown Facts About How Much Does Adding A Teen Driver Increase Your Auto ...

If your teenager's auto is in their name, they will be incapable to be provided on your plan, and also they'll have to obtain their own. Nonetheless, if a teenager falls under a moms and dad's policy, they can continue to be on that policy as long as they reside in the home and drive among the household automobiles. low cost.

Just like any driver, it is always best to have the minimal state called for insurance policy. Driving without any kind of protection is versus the law and also can feature some serious legal and also monetary ramifications. Guarantee Under Your Policy, It might make feeling economically to add your teenager to your insurance plan (cheaper car insurance).