Vehicle insurance generally offers 3 kinds of insurance coverage, or security, with different states having different minimum coverage mandates. BZ 3 Kinds Of Defense in a Cars And Truck Insurance Coverage: this covers occasions like burglary or damages to your vehicle in an accident.: this gives economic protection for your or others medical costs must any kind of arise from an accident or event while driving your vehicle.

If you live in a state that makes use of Personal Injury Protection to supply medical coverage on your automobile insurance coverage plan, you'll have options of protection as low as $15,000 in some states. A reduced amount of. perks. A representative or producer could additionally recommend a higher deductible for your PIP, also to maintain expenses down.

You may need to pay an additional insurance deductible and co-pay. Even if your deductible is just $500 with no co-pay, you're still paying $3,500 out-of-pocket now. As you can see, the cost savings readily available via lower protection limitations and also greater deductibles might be appealing, but likewise might not deserve the financial danger depending upon your private monetary situation.

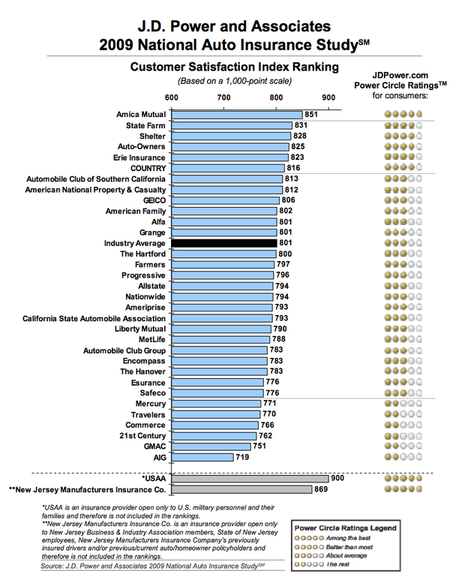

Cars And Truck Insurance coverage Prices quote Numerous firms treat insurance policy as an asset, frequently readily available and also with little distinction in functions or alternatives. Amica as well as our Unique Reference pick, USAA, both recognize that consumers are getting service, not just insurance.

Packing your items is one more means to lower your car insurance policy costs. 1 Just how do I ensure that I'm correctly covered for vehicle insurance?

Getting The Best Car Insurance Companies For April 2022 - Cnet To Work

auto insurance accident insurance companies auto

auto insurance accident insurance companies auto

When you have a clear photo of exactly how you utilize your automobile and also your priorities, you're prepared to look for insurance policy. Typically, it's a great suggestion to contrast policies from at least 3 different insurance companies (vans). You'll want to take into consideration fundamental elements such as coverage as well as price, but it's also worth examining possible insurers as well.

Kinds and quantity of insurance coverage Attempt to contrast apples to apples when choosing your insurance coverage. Every one of the plans that you examine should have the exact same kinds and also quantity of insurance coverage. insurance. It is difficult to compare policies, for instance, if one gives $50,000 in building damage liability coverage, another only $30,000, and also a 3rd $100,000.

Assessing insurance coverage firms While rate as well as insurance coverage might be making a decision factors when you purchase car insurance, it's worth thinking about the online reputation and monetary security of prospective insurance companies as well. Double-check that an insurance provider is accredited in your state by going to the internet site of your state's insurance division where you can additionally examine details regarding consumer problems submitted against insurance provider.

Online devices will commonly supply rankings information.

trucks credit score prices cheap car insurance

trucks credit score prices cheap car insurance

You will relocate: Where you live is a vital consider establishing your prices. Your credit score ratings have actually transformed considerably: Cars and truck insurance policy companies with the exception of those in The golden state, Hawaii, Maryland as well as Massachusetts consider your debt when establishing your rate - cheap auto insurance. Your driving history has boosted: If it's been some time considering that your last crash or driving infraction, your rate may enhance.

How Best Car Insurance Companies For April 2022 - Bankrate can Save You Time, Stress, and Money.

Your driving regimen has changed: If you're driving fewer miles nowadays or no longer commuting for work, you might intend to look around to see if you can obtain a reduced rate (cheap).

Whether you are a novice consumer looking at getting an automobile insurance coverage plan for your new auto or you are someone that is considering switching to a brand-new business, one of the most important things prior to you get started on the procedure of speaking to insurance firms is to first do your very own research study.

When you gather this details, it is crucial to check out several of the car insurance coverage companies you want online as well as contrast them. In specific, shoppers should look at their coverage needs responsibility, which is required by most states, complete coverage/comprehensive insurance (crucial and required if your auto is funded), without insurance as well as underinsured driver protection, accident coverage, accident defense insurance coverage, etc - car insurance.

Responsibility insurance policy is mandated by most states, Crash insurance policy covers you regardless of mistake, Comprehensive/full coverage insurance covers you in situation of damage to cars and trucks triggered by unforeseen tragedies or "disasters"-- occasions such as hail or a dropped tree resulting from severe climate conditions, or your vehicle striking a pet, etc.

Full insurance coverage vehicle insurance policy charges will vary for every consumer relying on their credit rating as well as driving and accident background. Each person's circumstance is one-of-a-kind. If you are a brand-new motorist or teenage motorist or also someone that is risk-averse, after that it is far better to take thorough, crash, and also uninsured/underinsured, along with medical settlements protection and personal injury protection, along with the responsibility insurance policy that many states mandate.

Things about Auto Insurance

Consequently, numerous companies will be pleased to obtain your service and checking out developing a long-lasting relationship with new consumers. business insurance.

Final Judgment Lots of vehicle insurance provider out there might use the insurance coverage you need. Nonetheless, they might not supply the least expensive cost or the ideal protection, which is why it is essential to go shopping and contrast your options. Based upon our specialist evaluation, we picked State Ranch as the overall best automobile insurer for 2022. cars.

: Many auto insurance provider offer several methods to save, such as discount rates for safe motorists, college trainees, or armed forces members.: The majority of insurance provider cover the fundamental detailed and accident insurance coverage, yet there are likewise various other, customized protections that may not be so commonly found, such as electrical or classic automobile insurance.: Each kind of coverage includes an optimum restriction that shows specifically how much of your losses will be covered by your insurance provider.

What Does Auto Learn more here Insurance Coverage Cover? Cars and truck insurance coverage covers damages to your vehicle, as well as other vehicles or residential or commercial property if you're involved in a crash. cheap auto insurance. What Are the Various Types of Auto Insurance?

For more information about our choice criteria as well as process, our full approach is readily available (auto insurance).

What Does Direct Auto Insurance Do?

Most of US drivers will certainly require to obtain some form of car insurance, as all yet 2 states (New Hampshire and Virginia) require locals to acquire a policy prior to obtaining behind the wheel. However past being lawfully needed, adequate insurance protection is important to driving, as it safeguards you from incurring excess costs if you enter a crash. auto insurance.

The typical annual costs for full protection is $1,655, according to Bankrate, yet relying on the quantity of insurance coverage you purchase,. To make sure that you're obtaining the very best prices and also insurance coverage, you'll wish to do an auto insurance policy evaluation as soon as in a while. vans. Let's dive in. Ideal cars and truck insurer The top-scoring vehicle insurance provider overall was Geico, reporting high customer complete satisfaction degrees in all areas of the country.

Its clients provide it premium ratings for fantastic service and support, along with some of one of the most practical insurance policy rates - insurance. Geico's smart commercials have actually made it among the best-known car insurance provider in the country, and it rates high in total customer contentment and auto claims satisfaction, according to J.D.

What affects the USAA's position is that its scope is narrower than those of most various other auto insurers, as the business just provides insurance coverage to service members, veterans as well as their households - cheapest auto insurance. That claimed, USAA is one of the most cost-efficient insurance companies out there, using prices that even defeated Geico's. Clients that switch over conserve approximately $725 a year.

What Does Best Car Insurance Companies 2022 - Buying Guide - The ... Do?

low cost cheaper car insurance perks automobile

low cost cheaper car insurance perks automobile

FAQs What's the ideal car insurance? Geico, Travelers, USAA, The Hartford as well as Amica are our top vehicle insurance picks for many motorists.

While State Ranch boasts high automobile cases fulfillment scores, they additionally have more than 1. 5 times the market standard in consumer grievances, according to the National Organization of Insurance Commissioners. Additionally, we have actually put together added listings based on various metrics. Review our finest auto insurance referrals for most inexpensive automobile insurance policy, army participants and also teens and young drivers.

When purchasing auto insurance coverage, you'll observe that prices differ by area as well as that state laws dictate which coverage is needed on your plan and what the minimal restrictions are, as well. There are lots of great insurance coverage business that operate regionally or in a choose amount of states.

insurers car vehicle insurance cheaper

insurers car vehicle insurance cheaper

Auto-Owners supplies protection in only 26 states, while Erie supplies it in simply 12 (dui). What kind of insurance coverage does your state legitimately require you to have? In a lot of states, bodily injury obligation protection as well as residential or commercial property damages obligation are essential to drive, but you'll desire to inspect the specifics of insurance policy premiums with automobile insurance coverage companies where you live.

Keep in mind that this listing does not consist of all types of coverage used by providers-- these are just the most usual. Compulsory insurance coverage: Simply concerning all states require the 2 types of insurance coverage below, which do not cover damage to your own auto or property.: This protection pays for injuries to others created by the insurance holder as well as various other vehicle drivers detailed on the policy - suvs.

Some Known Questions About Esurance Car Insurance Quotes & More.

If your automobile is financed, your lender may require you to bring complete protection, indicating both detailed and also accident. This protection spends for damages to your car in an accident arising from a crash between your automobile as well as another car or an object (cheapest auto insurance).: This insurance coverage spends for damages to your cars and truck triggered by an occasion apart from collision.

Nevertheless, we may receive compensation when you click links to services or products used by our partners (affordable auto insurance).

READY TO FIND THE VERY BEST CARS AND TRUCK INSURANCE POLICY FOR YOU? Or make use of Money, Nerd's firm matcher to compare firms in your state. Why Depend On Cash, Geek? The Most Effective Vehicle Insurance Coverage Companies for 2022Money, Nerd has rated the ideal automobile insurance firms based on numerous aspects, consisting of J.D. Power customer contentment ratings, monetary stability ratings from AM Finest and price.

GEICO received the greatest marks in our racking up system for 24 out of 50 states, while State Ranch ranked as the leading business in 10 states. These rankings, and our study on what makes these companies attract attention, can aid you when purchasing cars and truck insurance policy. Those simply looking for the most budget friendly choice can contrast this listing to our positions of the most affordable car insurance provider.

GEICO may not be the finest choice for those with a brand brand-new automobile. The business doesn't offer new automobile substitute coverage, which permits those with brand-new designs to be fully reimbursed for a brand-new vehicle after a crash. Without this, you'll just be compensated for the diminished value of your car.