When you need complete protection insurance for teenager vehicle drivers Let's say you have a Mercedes Benz and you wish to include your teen to your policy. After that the ideal protection for you will be complete insurance coverage (accident and extensive coverage) (trucks). The major reason behind this is; luxury or sporting activities autos have pricey parts as well as the repair service prices for these vehicles can be a bit expensive.

Because of this; if the vehicle obtains totaled in a crash then replacing the auto can dig an opening in your pocket - car. With complete protection insurance coverage, you do not need to stress over the repair service or substitute of the auto. The cost of full insurance coverage can be greater yet it will certainly go to the very least worth it.

This is due to the fact that the price of the costs is going to be more than the value of the automobile. Cost of including a teenager to your vehicle insurance plan Confused if you should include your teenager to your plan or you should purchase a different policy for him or her? We have a basic remedy for you, you can merely ask your firm for the three various sorts of quotations.

You will get a clear idea of how much you will have to pay in each situation. According to the evaluation by Rate, Pressure, including a teenager chauffeur to your policy is fifty percent as costly as getting a different plan for the exact same teenager motorist. Adding your teen motorist to your plan is a cheaper option for you - cheap car insurance.

On the other hand, the average cost of adding a teen chauffeur to your existing plan will certainly be $1690. This is practically fifty percent of the individual policy for a teen vehicle driver. Generally, the yearly expense of car insurance for a parent without a young adult is $2980. While the annual ordinary cars and truck insurance coverage price with a teen motorist will certainly be $5740.

The smart Trick of Best Car Insurance For Teens And Young Drivers For May 2022 That Nobody is Talking About

This is the typical distinction between the various car insurance policy rates for different accounts. Distinction between teen car insurance policy as well as young motorist car insurance coverage This is also a very vital section to cover for all the parents and the teen and also young vehicle drivers. A lot of parents obtain perplexed in between teen vehicle insurance coverage and also young chauffeur car insurance coverage. credit.

It is very important to comprehend that teenager auto insurance coverage is different from car insurance policy for young motorists. Teenager automobile insurance coverage is for the teens that are lawfully qualified to drive; vehicle drivers between 16 years as well as 19 years of ages. While young motorists are the ones between 21 years and 25 years of age. insured car.

Some national insurance provider still consider teen chauffeurs and also young motorists the very same. It can be a little bit costly for young motorists as well as a little bit affordable for teenager chauffeurs. It is always far better to make it clear with your service provider. Prior to buying your plan, ask the insurance coverage company regarding teen drivers and also young drivers.

vehicle insurance vehicle insurance car insured cheap car insurance

vehicle insurance vehicle insurance car insured cheap car insurance

Vehicle insurance policy rates can differ a great deal for various states, cities, as well as even areas. The area where the driver lives play a significant duty in the automobile insurance coverage price. A motorist living in Hawaii may get lower insurance coverage rates as contrasted to a vehicle driver in California. Therefore it is essential to examine the cars and truck insurance rates for various states prior to acquiring your residence.

These aspects include the problem of the road, the environment kind, as well as the crime price of the state. The company then analyses all these factors and after that determines what the insurance rate will certainly be for the driver., if a state has high criminal activity rates then the opportunities of car stealing are higher - insure.

The Best Strategy To Use For The Staggering Cost To Insure A Teenage Driver - Forbes

car insured cheap prices car insurance

car insured cheap prices car insurance

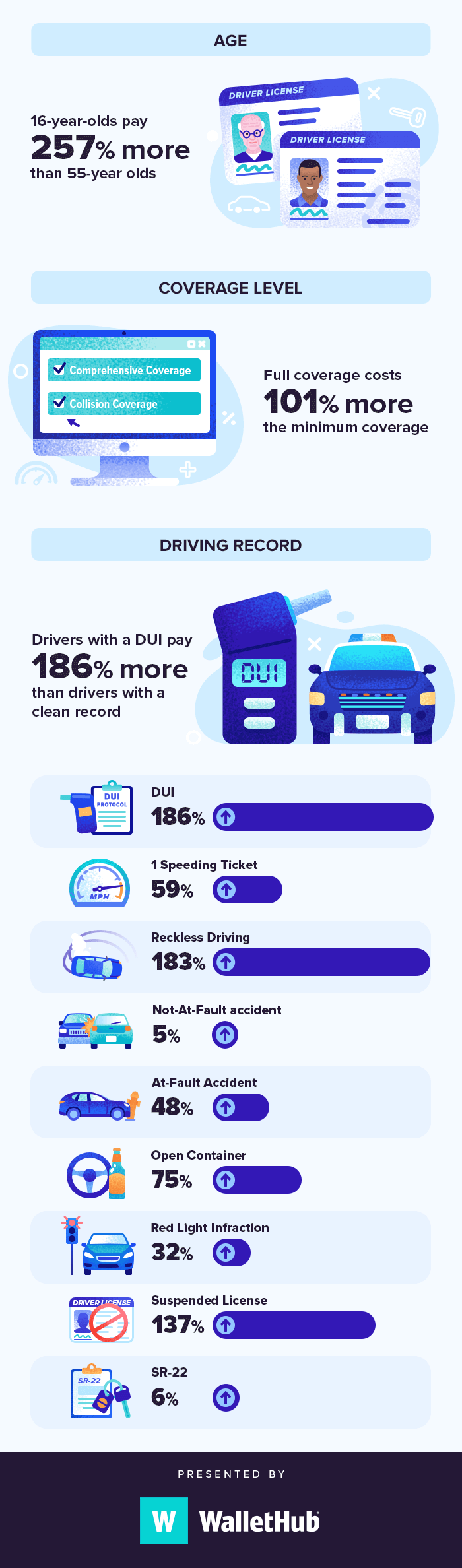

The gender of the chauffeur influences a lot on the automobile insurance price for any type of state, city, or area. Usually, we can claim that a male teen motorist needs to pay $380 added as contrasted to a women teen driver. As per the insurance service providers around the nation, have much clean record and also absolutely no to one at-fault crash on record.

auto insured car cheapest car cheap car insurance

auto insured car cheapest car cheap car insurance

affordable affordable car insurance cheap auto insurance cheap

affordable affordable car insurance cheap auto insurance cheap

Plus they often tend to cross the speed limit a lot more as compared to women vehicle drivers. Therefore, insurance coverage companies locate women motorists much safer customers than male vehicle drivers. Typically, the female teen driver pays $3180 for minimal protection, while a male chauffeur pays $3975 for minimal insurance coverage. Let's see the malfunction of this to have a clear photo.

Including a teenager little girl can enhance your insurance prices by $1098 yearly. And also this is much reduced than the typical insurance policy expense for a male teenager chauffeur. The factor behind this is; according to insurance coverage carriers around the nation, women motorists are much more secure as compared to male drivers. These prices differ for various automobile insurance policy companies.

Obtain as many discount rates as possible The most effective component of obtaining teen vehicle insurance is you can use for a pupil price cut. Every firm has its conditions for student discount rates. But on standard, the chauffeur should have at least approximately B grade or greater to obtain certified.

And afterwards you just need to compare the rates from all these firms to inspect which one has the most inexpensive rates. By combining the prices you'll get a better idea of exactly how different business bill for the very same plan - credit. Yes, each business can have a different rate for the very same vehicle driver.

All about How Much Is Car Insurance For A 16-year-old? (& How To Save)

Insurance coverage firms attach the vehicle to either a beacon-like gadget or an app. This aids them to keep the pertaining to the driving habits. Based upon this information the insurance coverage service provider can offer you a customized insurance rate. It is important to keep in mind that if the company finds out that your driving behaviors are hazardous then the prices can also boost.

Add a teen driver to the parent's plan The ideal way to get the most affordable vehicle insurance coverage for new chauffeurs is to add them to their parent's plan. There are some incredible advantages of remaining in your moms and dad's plan.

Plus you'll additionally obtain various other discounts like multiple cars and trucks discount rates as well as even great and experienced motorist price cuts. So integrating all these discounts your insurance rates can get reduced to almost 60 percent of your existing prices. Additionally, if the parents have actually spent for the automobile after that it is mandatory to obtain an insurance plan under the moms and dad's name.

Thus they have no various other alternative than to include their policy under their parent's existing policy. 5. affordable car insurance. Prevent high-value autos for the teen vehicle drivers Yes, we recognize your teen child is requesting that high valued luxury car. The insurance price for that automobile can nearly be double that of any type of low-valued vehicle.

Again this can influence your insurance rates. The very best approach here is to provide a lower-valued automobile to your youngster. The actual price worth of that vehicle will certainly be reduced hence your insurance provider will certainly provide lower insurance coverage rates for the vehicle. 1. Can my teenager drive my car if he or she is not detailed on the plan? No, you can not allow your youngsters to drive the car up until their names have been included in the plan.

Adding A Teen Driver To Car Insurance - Nationwide Things To Know Before You Buy

Do teens require to get full insurance coverage vehicle insurance coverage? No, teen motorists can drive legally with the state's minimum needed insurance coverage. Complete coverage insurance policy is suggested for teenagers to avoid big repair expenses.

The reason behind this is; as per the insurance provider around the country, teenager motorists have the highest involvement in massive road crashes. Plus they obtain involved in reckless driving as well as Drunk drivings. 4. Which is the ideal company to buy vehicle insurance for 17 years of ages? Providing the credit scores to one company will certainly be unjust to other firms (accident).

The leading five car insurance companies for teenager chauffeurs are; Allstate, Progressive, Erie, Nationwide, and also USAA. Is it far better to add the teenager drivers to the moms and dad's plan? Including a teenager driver to a moms and dad's policy can be a wise decision.

Still, have some doubts regarding acquiring car insurance for teenager motorists? We have a specialist group for you. Contact us with us today and also discuss all your inquiries - cars.

car insured car insurance companies laws

car insured car insurance companies laws

Auto insurance firms are mostly thinking about something: Are you a secure driver or a risky one? The solution to that question is mosting likely to be one of the most essential element in establishing what you pay yearly for your plan. The much safer (and a lot more experienced) you are behind the wheel, the less expensive a new insurance coverage will certainly be.

The Facts About How Much Does Insurance Cost For A 16 Year Old Revealed

"Age has the biggest influence on your rate considering that young vehicle drivers without experience have statistically revealed to be much more immature behind the wheel. As well as that results in extra insurance cases, making them a lot more pricey to insure. Simply put, the more youthful the chauffeur the higher the price." It's demonstrably true that teenager vehicle drivers are the riskiest group when driving today.

"Teens are two times as likely to be involved in a mishap and also 50 percent most likely to be associated with a fatal mishap. Anytime you add a driver that is most likely to be associated with even more mishaps along with more significant crashes, the increase in insurance coverage costs will certainly be high." Fortunately for parents is that teen driving information is trending in the appropriate instructions, even if the needle relocates slowly toward raised safety - cheap car.

Deadly collisions dropped 59 percent for 17-year-olds, 52 percent for 18-year-olds, Learn here as well as 47 percent for 19-year-olds (cheapest car insurance). "When you check out the last 15 years approximately, as states have actually applied these programs, there has actually been a great deal of success in minimizing deadly crashes," claims Anne Mc, Cartt, the freeway safety institute's elderly vice head of state for research.